ICYMI - "On the Side of the Angels" - How a deal with Warren Buffett could transform America's transportation & energy future

A legacy-defining "2-fer-1" deal that would transform US rail service - AND create a national SuperGrid for renewable energy.

By Bill Moyer

On the morning of May 4, 2019, I won a very particular lottery. 40,000 people from around the globe had made the annual pilgrimage to Berkshire Hathaway’s shareholder meeting. They had come to hear and, if chance allowed, to speak with the Oracle(s) of Omaha, Warren Buffett and Charlie Munger. That morning, five years ago, my name was drawn to ask the first question. Unlike the vast majority of the pilgrims, I was not there to pay tribute, but to make a proposal for electrification of Bershire Hathaway's rail company BNSF, owner of the railroad between Chicago and the west coast.

In 2016, I co-authored the book Solutionary Rail: A people-powered campaign to electrify America’s railroads and open corridors to a clean energy future. Our book proposed that Berkshire Hathaway (BH) enter a public-private partnership with state and federal governments to electrify the Northern and Southern transcontinental corridors of its BNSF railroad. We proposed that along with rail electrification, the partnership co-locate high voltage transmission along its right of way.

Our book drew from studies that showed the potential for such transmission infrastructure to unlock stranded renewable energy assets in the Midwest and Southwest, to stabilize the variability of renewable energy and to speed the energy transition. We demonstrated how the electrification of BNSF would clean up and speed up its operations, as well as reduce the cost of maintenance and energy to power its trains. By all accounts, ours was a win-win-win proposal for Berkshire Hathaway, the public, and the planet.

I should mention that Solutionary Rail is a project of Backbone Campaign, a creative activist organization that I direct. Founded in 2003, Backbone is known for its use of spectacle imagery, pioneering Kayaktivism, and popularizing the use of light projection for protest. Our book was a new tactical tool, an arrow in our creative communications quiver and the anchor for a decade of work to put US rail in service of public interests.

Between 2016 and 2019, we had repeatedly called Mr. Buffett’s office, sent books and letters to him as well as BNSF headquarters in Fort Worth. We received not even one reply. It was unclear whether the benevolent billionaire was being insulated from our queries or was simply ignoring us. There was no way to be sure. So, my team and I were in Omaha in May 2019 to deliver our proposal in person.

Starting at sunrise, we greeted the long lines of pilgrims with leaflets and a giant banner of the type Backbone is known for (shown above). We urged Berkshire Hathaway (BH) shareholders to combine their assets in a deal with the public to deliver a more sustainable energy and transportation future.

Getting inside the stadium and entering the lottery was a fluke. Having my name drawn to ask the first question was close to a miracle. Even with an irritating echo in my monitor, in a stadium full of people, with hundreds of thousands more watching online, I was able to pitch the proposal to Mr. Buffett and Mr. Munger directly.

Mr Buffett’s response was politely dismissive. But when he turned it over to his partner, the late Charlie Munger, Mr. Munger replied in his gravelly voice, “Well, over the long term, our questioner is on the side of the angels. Sooner or later we'll have it more electrified. I think Greg [Abel] will decide when it happens." Greg Abel is BH vice chair of Non-Insurance Business Operations and heir apparent to Mr. Buffett.

Despite Mr. Munger’s encouraging words, BNSF continued to fight our and other’s calls to electrify at every turn.

In 2020, the city council of La Crosse, Wisconsin was considering a resolution in support of Solutionary Rail’s proposal. After years of ghosting Solutionary Rail, the BNSF communications department were forced to respond. They issued a long and stern letter warning La Crosse against the dangers of “premature electrification.” Though this smile-worthy warning sounds like a condition one might see a urologist for, there is actually nothing premature about rail electrification. La Crosse, Wisconsin understood this, and passed the resolution with bi-partisan support.

In 2024, after years of grassroots pressure from environmental justice (EJ) organizations and trackside communities, the California Air Resources Board (CARB) released emissions rules and a framework for transitioning locomotives operating in California to zero emissions over the coming decades. BNSF has responded with an aggressive campaign to undermine this effort. Knowing that it sets a state standard that could quickly become national policy, BNSF has mobilized the industry and created a pressure campaign to keep the EPA from granting the necessary waiver for this state rule to go into effect. Solutionary Rail has followed the lead of our EJ allies at the Moving Forward Network to urge the EPA to grant California the necessary waiver.

World moves to electrified rail

Ironically, 125 years ago, the US was leading the way on rail electrification. In 1895, the B&O Railroad’s Baltimore Beltline was electrified. In 1915, GE built the first electric locomotive with capacity for regenerative braking. In 1928, my home state of Washington had 759 miles of electrified rail. Engineers came from around the globe to visit the mighty Milwaukee Road to learn about electrification. Nearly 50 years after its demise, it remains famous for using the concentrated power of overhead lines to bring heavy trains up steep mountain grades, often aided by the regenerative braking power from trains heading down the opposite slope.

The rest of the world propelled rail electrification forward without regulatory mandates, because it is simply a common sense infrastructure investment.

Russia finished electrifying the Trans-Siberian Railroad nearly twenty years ago.

India is on track to have 100 percent of its track electrified by the end of this year.

The European Union has electrified more than 60 percent of its track.

China has electrified two-thirds of its rail, amounting to over 60,000 miles of track.

Iran, South Africa, and Turkey are all electrifying their railroads.

Rail infrastructure in the mountainous countries of Ethiopia and Switzerland are both 100% electrified. What’s more, heavy trucks that are passing through Switzerland are shuttled through the country on roll-on/roll-off electric trains.

Catenary electrification projects in comparable economies to the US like Germany show that electrification can cost as little as $2 million per track mile or $2.5 million per double-track mile. For years, the US estimates have been exaggerated to be $4.8 million or more per mile. These numbers were inflated by assumptions that tunnels would need to be crowned, bridges rebuilt, overpasses lifted. In truth, a 25kV catenary requires only about 1 foot of clearance above equipment. It is true that certain sections of track are more expensive to electrify than others. Today’s advanced battery-locomotives offer a way to bridge those gaps. Electrifying the most cost effective sections and using battery-electric locomotives to bridge the gaps also allows trains to benefit from regenerative braking. This is referred to as discontinuous electrification, increasingly seen as the obvious path toward the gradual electrification of US railroads.

Catenary electrification has been estimated to have an annual return on capital of 8-15% and as much as 30% on the most densely utilized corridors. In other words, investment in catenary electrification has the potential to pay for itself in less than a decade. This is a pretty quick return on investment for infrastructure that is designed to last generations. Whether electrification is seen by BNSF as a threat or opportunity depends on how it weighs a reduction in trading short term profits in exchange for long term savings. Currently, they are clearly focused on the short term.

Even though rail electrification is a tried and true, economically advantageous technology, less than one percent of US track is currently electrified. This is largely due to the fundamental difference between the US and most of the rest of the world.

Private Profit-vs-Public Good

Outside the US, rail infrastructure and most operations are publicly owned. Public infrastructure investments can be financed more cheaply and gradual returns on capital and or societal benefits justify those investments. In contrast, the vast majority of US rail infrastructure is privately owned. It is thus burdened not just to turn a profit, but to maximize that profit, especially if it is publicly traded.

The consequences for management of any publicly traded Class 1 railroad that attempts to pivot toward long term growth over short term profit could be career ending, when activist investors inevitably intervene to push them out. That recently occured at Norfolk Southern (NS) when asset manager Ancora sought to push out NS CEO Alan Shaw. The group failed initially, but board members they installed found other means for replacing him. Shaw’s replacement, Mark George, in his first public statement doubled down on NS commitments to prioritize stock buybacks (more on this issue below) and efficiencies over service.

Turning a profit is not something we require of other critical infrastructure such as public roads and freeways, waterways, or airports. The nationalism of the Cold War allowed the US to overcome Anti-Federalist tendencies to make direct investment in infrastructure. In contrast, the DNA of our privately-owned rail system was shaped by a time when the ideology of state sovereignty made national direct investment in infrastructure impossible. This likely connection between our current predicament of a private railroad infrastructure and the states rights doctrine used to perpetuate slavery is unfortunate, but worthy of future exploration.

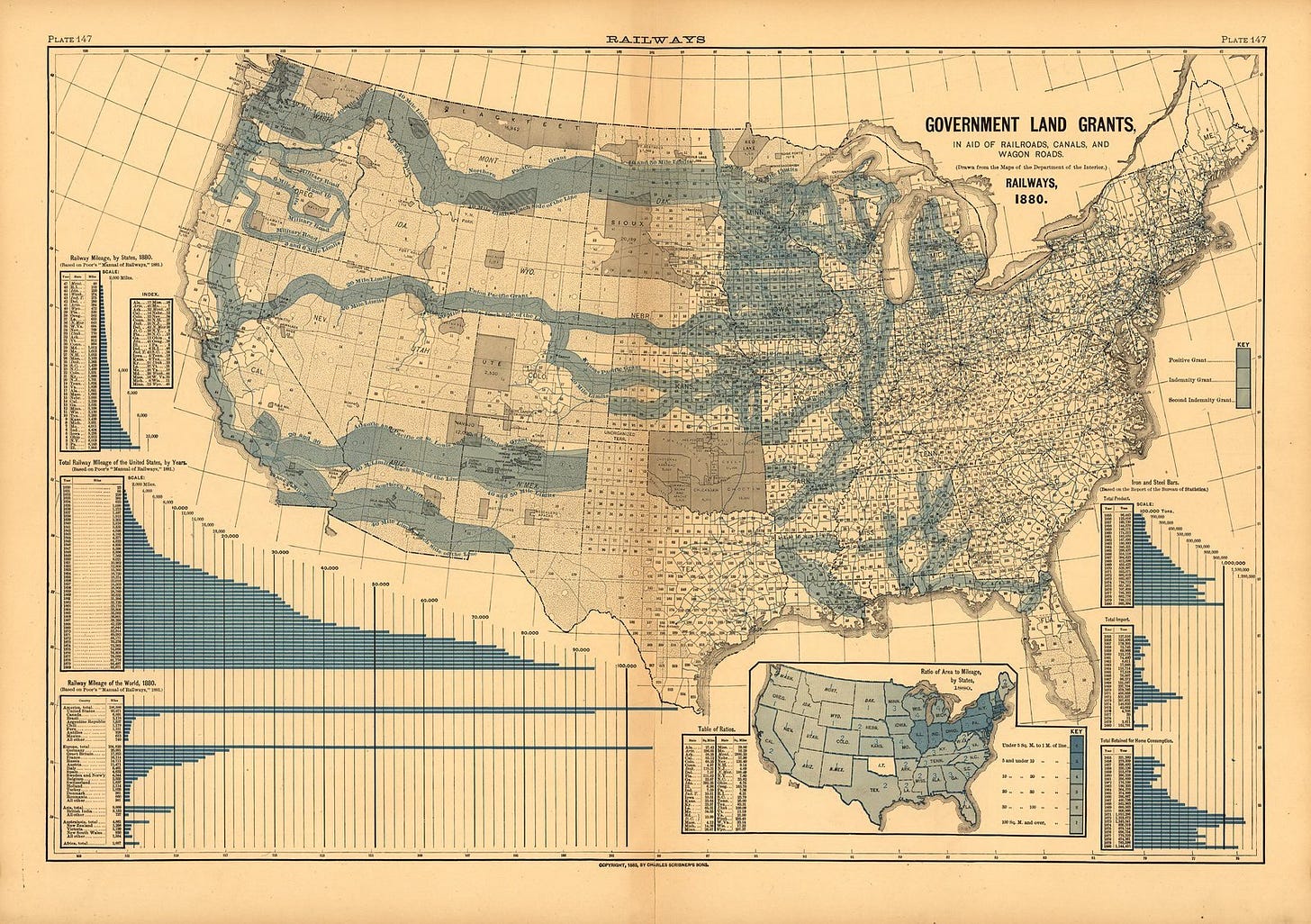

For now, let’s just acknowledge that land grants provided the foundation for today’s railroads. These were among our first and largest public private partnerships. Early fears that these powerful corporations would abuse their monopoly powers to discriminate against certain shippers and favor others were justified. Land grant terms to the public were unfulfilled and litigated up until the US entry into WWII. Despite 150 years of regulatory and deregulatory measures the US has yet to find a viable way for this private-ownership model to thrive while simultaneously delivering to the nation the service and solutions we deserve.

After 45 years of deregulation and relative impunity, investor capital has identified US rail infrastructure as a highly profitable resource from which to extract short term profits without regard for its long term resilience or the public purposes it was created to serve. It's incumbent upon us to chart a new path forward while there remains a rail infrastructure to save, renew, and harness.

In 2024, Buffett questions owning infrastructure

Mr. Buffett’s 2024 letter to shareholders indicates that his scale may be tipping toward short term profits and away from the burden of owning infrastructure. The corporate railroad industry’s fervent pursuit of lowering operating expenses relative to revenue has taken a toll on US freight railroad service, labor conditions, and public health and safety. (See charts on annual external cost of freight in this report about my recent testimony to the Surface Transportation Board.) Class 1 railroads maximize profit by extracting value from the infrastructural resource, constantly trying to make more with less. Though Buffett’s BNSF has attempted to buck this trend in its management style and rhetoric, it is not immune to the trend. In fact, on October 4, the WSJ reported that BNSF has hired a “PSR” expert Ed Harris to help them “streamline their business.”

In his letter, Buffett acknowledged, “The country can’t run without rail, and the industry’s capital needs will always be huge. Indeed, compared to most American businesses, railroads eat capital.” He noted the fixed asset value of BNSF is $70 billion. But he bemoaned the fact that "BNSF must annually spend more than its depreciation charge to simply maintain its present level of business.” He continued, “This reality is bad for owners, whatever the industry in which they have invested, but it is particularly disadvantageous in capital-intensive industries.”

What Buffett was saying is the investment needed to keep up the railroad exceeds the amount it is allowed to deduct from taxes based on assumptions about reduced value due to wear and tear. Deferred maintenance is resulting in results in infrastructure that is deteriorating at a faster rate than the companies are repairing it.

Setting aside the fact that BNSF actually generated massive profits for Berkshire Hathaway, Mr. Buffett’s message indicates little appetite for investments in electrification, regardless of their long term payoff. In the section of the letter concerning Berkshire Hathaway Energy (BHE) he grew even more pessimistic.

“Our second and even more severe earnings disappointment last year occurred at BHE . . . investors are becoming apprehensive . . . Climate change adds to their worries.” Buffett noted that traditional utility regulation which guarantees fixed returns “has been broken in a few states, and investors are becoming apprehensive that such ruptures may spread.” He finishes, “Berkshire can sustain financial surprises but we will not knowingly throw good money after bad.”

So, even though Berkshire Hathaway owning transmission, generation, and a railroad that is screaming to be electrified, and despite Solutionary Rail’s best efforts to help him, the captain of that ship (Warren Buffett) cannot see a pathway forward. Solutionary Rail’s proposal that BH combine these assets for long term profit and societal benefit feels no closer than it did in 2016. One of the most successful capitalists of all time seems to be saying that, in the case of large infrastructures such as utilities and railroads, increasing risks and regulatory mandates may be liabilities that threaten to undermine the profits he seeks.

Building the Steel Interstate

Solutionary Rail has long asserted that a robust US rail infrastructure is critical to the long term public interest, as is its electrification. It is also the solution hiding in plain sight to solve the transmission right-of-way problem, the single biggest obstacle to decarbonization. Until now, we’ve assumed that the electrification and transmission co-location would be a public private partnership - a complicated mix of regulatory carrots and sticks. But maybe the answer is far simpler.

Our freeways, airports, and waterways are not required to turn a profit, so why should railroads? Aren’t interstate railroads simply a type of road, a “Steel Interstate?” Our other infrastructure is owned and maintained by the public for societal benefit. Why must our railroads be treated differently?

Trains could be treated similar to trucks or planes, paying tolls for access to tracks instead of owning them. This open access model could apply lessons from the EU where it was implemented to allow rail operators access to previously inaccessible tracks in other member states. This model would free up railroad companies to concentrate on competing for customers by providing better service, rather than relying on monopolistic control of track and skimping on maintenance to finance stock buybacks and subsidize dividends.

Publicly owned track, when considered in light of our highways and waterways, is not revolutionary but common sense, and familiar. It is also, with variations, how most of the rest of the world operates its rail infrastructure. We have historic experience that may guide us.

When the railroads needed a major upgrade during WWI, the federal government took them over. When railroads wanted an exit strategy from transporting passengers, they struck a deal with the feds to create Amtrak, and for a while the railroads even paid to be relieved of that duty. The public rescued critical freight infrastructure in the Eastern US after a series of major railroad bankruptcies by creating Conrail. Once profitable, Conrail was then re-privatized and split between Norfolk Southern and CSX.

Many states own shortline railroad infrastructure. It is usually purchased by states to prevent its abandonment due to its critical role as transportation infrastructure for agricultural or manufactured goods. Ironically, these shortlines often remain dependent on the former Class 1 railroad to which they connect and the public ends up functionally subsidizing monopolistic business practices of the former parent railroad.

Striking a deal with Mr. Buffett

For years, I have heard railroad industry calls for regulators and Congress to “level the playing field” by making trucks pay their fair share. Their point is valid to the extent that trucking companies are not held responsible for wear and tear of the roads they drive on and only pay a fraction of the cost of the maintenance for the damage they inflict. That said, infrastructure wear and tear is only one part of the external costs heavy trucks inflict on society. Air and water pollution, congestion, traffic safety and GHG emissions can be quantified - as made clear by the Congressional Budget Office as I explain here - but they will not be recouped or averted by merely raising taxes on fuel or instituting a vehicle miles travelled (VMT) tax. Studies consistently show that without dramatic service improvements on the part of railroads, we are stuck with the negative impacts of a persistent trend of freight to shift from trains to trucks.

So, let’s actually level the playing field. Let’s do this by relieving railroads from the burden of juggling the contradictory mandates of shareholders demanding short term profits versus the long term public and national interest in the maintenance, enhancement and electrification of our railroad infrastructure. This infrastructure clearly cannot serve two masters - and when push comes to shove, public and national interests must prevail.

As owners of the only Class 1 railroad that is not publicly traded, Mr. Buffett - or Mr. Abel - might consider making a deal even more transformative than what we proposed back in 2016. If they agree, it would set the stage for a tectonic shift toward a truly sustainable US transportation and energy system.

In such a deal, BNSF (and other Class 1 railroads) would work with the federal government to institute a vertical separation of infrastructure from operations. It could be voluntary and staged. It is difficult to imagine Union Pacific railroad or other Class 1s holding onto the burden of infrastructure that is mandated to be electrified and maintained when their competition is no longer burdened by such requirements. In exchange, the public gets to put this critical national infrastructure to work solving 21st Century problems.

Growing regulatory pressure to grow mode share, electrify rail yards and mainlines, and address the aging and costly transmission infrastructure seems to concern Mr. Buffett. This may represent a confluence of circumstances that may be exactly what the US needs to finally get started on putting rail in service of public interests instead of mere profit maximization. It could allow us to shift long haul freight from trucks back onto trains, electrify US railroads like the rest of the world is doing, and simultaneously build a National SuperGrid, or "electron superhighway" as some have called it.

This would provide an opportunity for the nation’s primary railroads to shed the burden of maintaining their track infrastructure by creating a Steel Interstate system under public ownership. Railroads that wish to participate could vertically separate their train operations from tracks. The federal government would assume responsibility for tracks and right of way.

Railroads would then be allowed to focus on operating trains and to concentrate their energies on growing their market share by improving service. This would level the playing field with trucking companies which already operate on public infrastructure and would allow train operations to take advantage of the energy efficiency of steel wheels on tracks.

Similar to what has already been implemented in Europe, the system would offer open access to all rail operators, introducing competition and dismantling monopolistic practices. In essence, the Steel Interstate would operate as a toll road for trains. New businesses could provide services such as new passenger routes and mixed freight. Primary railroads are primarily focused on bulk and container shipments. Returning access to rail for mixed freight and removing restrictions on shorter hauls would give smaller manufacturers and family farms an alternative to trucking long distances. Taking trucks off roads and moving people from cars and planes to rail has multiple benefits in terms of reducing carbon emissions, road wear and congestion, as well as improving safety.

BNSF's Southern Transcon is a perfect place to start. It is one of the nation’s busiest freight lines, connecting the Los Angeles and Long Beach ports, the country’s biggest, with the inland rail hubs of Kansas City and Chicago. In addition, it traverses the three grids that now serve the nation – west, east and Texas. Co-locating transmission on this corridor would help stabilize all three, turning around a trend toward increased outages, while unlocking massive wind and solar potential along the way.

Reconnecting America

A deal with Buffett's Berkshire Hathaway could be the pivot that initiates a broader transformation which literally reconnects our country and renews a sense of national common cause, a pathway to reconnect America. Much of today’s political polarization stems from a sense that rural areas and smaller communities have been left behind, while metropolitan areas, particularly on the coasts, have shot out ahead economically. Loss of transportation access has a lot to do with this. Many communities no longer have rail service, and are forced to use more expensive trucking, driving farmers and manufacturers in those areas out of business. A national agenda to reconnect America by creating a Steel Interstate system could help bridge divides and begin to heal our nation.

The publicly owned, maintained and electrified Steel Interstate is a win-win proposal for pretty much everyone. By removing the corrosive impact of short term greed from control of this critical national infrastructure, a wide range of stakeholders benefit. This includes: rural communities, communities burdened by pollution from the freight system, shippers large and small, the renewable energy industry, Indigenous tribes along rail corridors, an expanded railroad and electrification workforce, US manufacturers and anyone who is impacted by the freight transport system or climate change - which is everyone.

It is worthy of a serious conversation about this potential path forward. We can build the system incrementally, but because the BNSF Southern and Northern Transcons are such obvious corridors to begin with, working with Mr. Buffett and Mr. Abel should be the highest priority. This is a vision that is - as Mr. Munger said, “On the side of the angels.” So let’s get going.

Join the Solutionary Rail team

We invite you to be part of this people-powered campaign to put American railroads in service of the public interest through rail electrification, shifting freight and people from roads to rail, and using rail corridors to transmit renewable energy. Participate in webinars, strategy sessions and skill sharing with community and technical experts by signing up at SolutionaryRail.org.

Support this work with a tax-deductible donation here. To buy our book, Solutionary Rail - A people-powered campaign to electrify America's railroads and open corridors to a clean energy future, go here. And please sign up below for a free subscription to our Solutionary Rail substack and Reconnect America podcast using the button below.

Timing is everything in life.

All those Angelenos could help move this forward.

How will Trump's takeover of the EPA affect rail?